Medicare Advantage Plans, also known as Part C, are an all-in-one option. They are offered by private Medicare-approved insurance companies like Aetna, Humana, etc., or the Kaiser Family Foundation. Usually, these plans are managed like an HMO or PPO insurance plan.

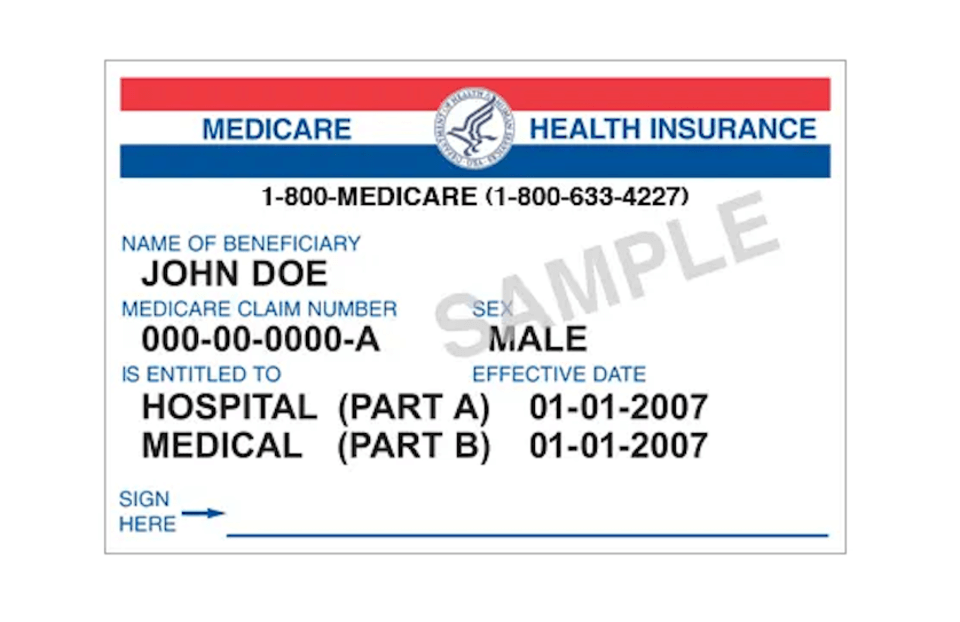

If you join a Medicare Advantage Plan, you still have Medicare. These Part C plans are bundled insurance plans that include Medicare Part A (hospital insurance), Medicare Part B (medical insurance), and usually Medicare drug coverage (Part D).

If you join a Medicare Advantage Plan, you still have Medicare. These Part C plans are bundled insurance plans that include Medicare Part A (hospital insurance), Medicare Part B (medical insurance), and usually Medicare drug coverage (Part D).